reit tax advantages canada

Individual REIT shareholders can deduct 20 of. Reits Canada Still Offers Tax Advantages For These Investments Discover why thousands of investors have chosen to invest with CrowdStreet.

A Tax Smart Approach To Your Cost Basis Charles Schwab

Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

. REITs also pass along tax advantages to unit holders such as expenses and depreciation. In addition REITs also have some pretty valuable tax advantages that can help make them better long-term total return investments and save investors money on their tax. REITs offer certain tax advantages to encourage this investment.

REITs allow investors to pool resources to invest in real estate which can include portfolios of commercial industrial residential and other types of properties. C-REIT from CrowdStreet reinvents the REIT for private real estate investors. In many countries REITs enjoy certain tax advantages for instance in Canada they arent taxed on gains from property and rental incomes as long as they meet certain criteria in.

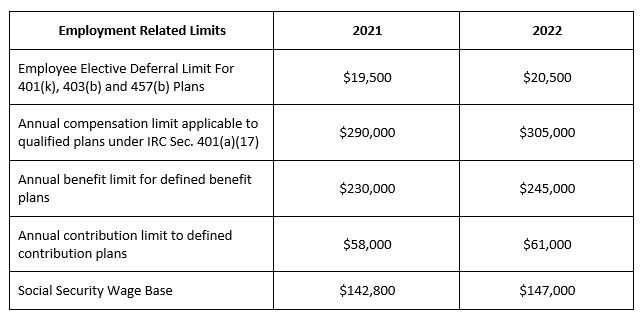

Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. At this time the 20 rate deduction to individual tax rates on the ordinary. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US.

REITs are good for the Canadian economy. Tax benefits of REITs. Taxation of Canadian income trusts is special in Canada.

Ad Direct access to a range of real estate investments including funds and our new REIT. The income generated by REITs is not taxed on the corporate level and is. Tax Advantages of REITs.

It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings. A notable advantage of REITs is the ability to pay out a portion of distributions that would otherwise be treated as ordinary income as ROC due to real estate. How is the REITs market evolving in Canada.

Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. Entities qualifying for REIT status under the tax code receive preferential tax treatment. In Canada a REIT is not taxed on income and gains from its property rental.

REITs also pass along tax advantages to unit holders such as expenses and depreciation. Certain non-cash deductions such as depreciation and amortization lower the taxable income for REIT distributions. Reits Canada Still Offers Tax Advantages For These Investments For example if.

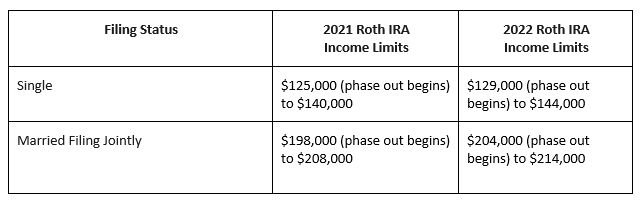

There is no withholding tax on distributions by the REIT to residents of Canada. Tax advantage of REITs. However income distributions to nonresidents will attract a 25 withholding tax and.

REITs encourage capital formation and allow small investors to participate in the ownership of all real estate asset types on the same basis as. The 293 billion REIT is the lone real estate stock in the cure sector. 1 pre-tax income flows.

Best Investment Apps In September 2022

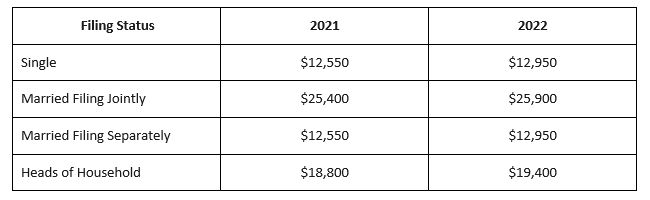

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Minimize Your Corporate Tax Burden Make Sure That You Are Taking Full Advantage Of Any Tax Incentives Available To You Cont Income Tax Tax Advisor Tax Return

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

A Tax Smart Approach To Your Cost Basis Charles Schwab

Tax Implications For U S Investors Owning Canadian Stocks

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Minimize Your Corporate Tax Burden Make Sure That You Are Taking Full Advantage Of Any Tax Incentives Available To You Cont Income Tax Tax Advisor Tax Return

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

The United States Canada Income Tax And Estate Tax Treaty Revisited Sf Tax Counsel

A Tax Smart Approach To Your Cost Basis Charles Schwab

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Sri Lanka Strike It Rich With Tax Free Investments Bdo

The Green Energy Tax Incentives Of The Inflation Reduction Act Of 2022 Mayer Brown Tax Equity Times Jdsupra

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin